Introducing Tax Shrink

By Christian Prokopp on 2024-03-14

Tax Shrink is a new online tool that helps owner-operators of Limited companies in the UK calculate and visualise the ideal salary-to-dividend ratio to maximise their net income, considering various taxes and national insurance contributions.️

Tax Shrink

In the UK, smaller Limited companies often have one or few directors who own and operate the business. Identifying the income strategy, especially the split between salary and dividends, can significantly increase their net income. In extreme cases, it could mean over 20% difference.

As an owner-operator, I faced these questions and was dissatisfied with the numerous tax calculators online. Calculating dividends, income, or corporation tax is helpful, but they are interdependent. The intricate play between salary, employer NI, employee NI, marginal relief for corporation tax and corporation, dividend, and income taxes is complex when considering both the Limited and personal income situation. In addition, the changes to National Insurance during the 2023/24 tax year broke many online calculators' assumptions.

The personal quest to understand and calculate the optimal scenarios gave rise to Tax Shrink. It lets you graph and calculate the ideal and worst salary-to-dividend ratio for owner-operated Limited companies.

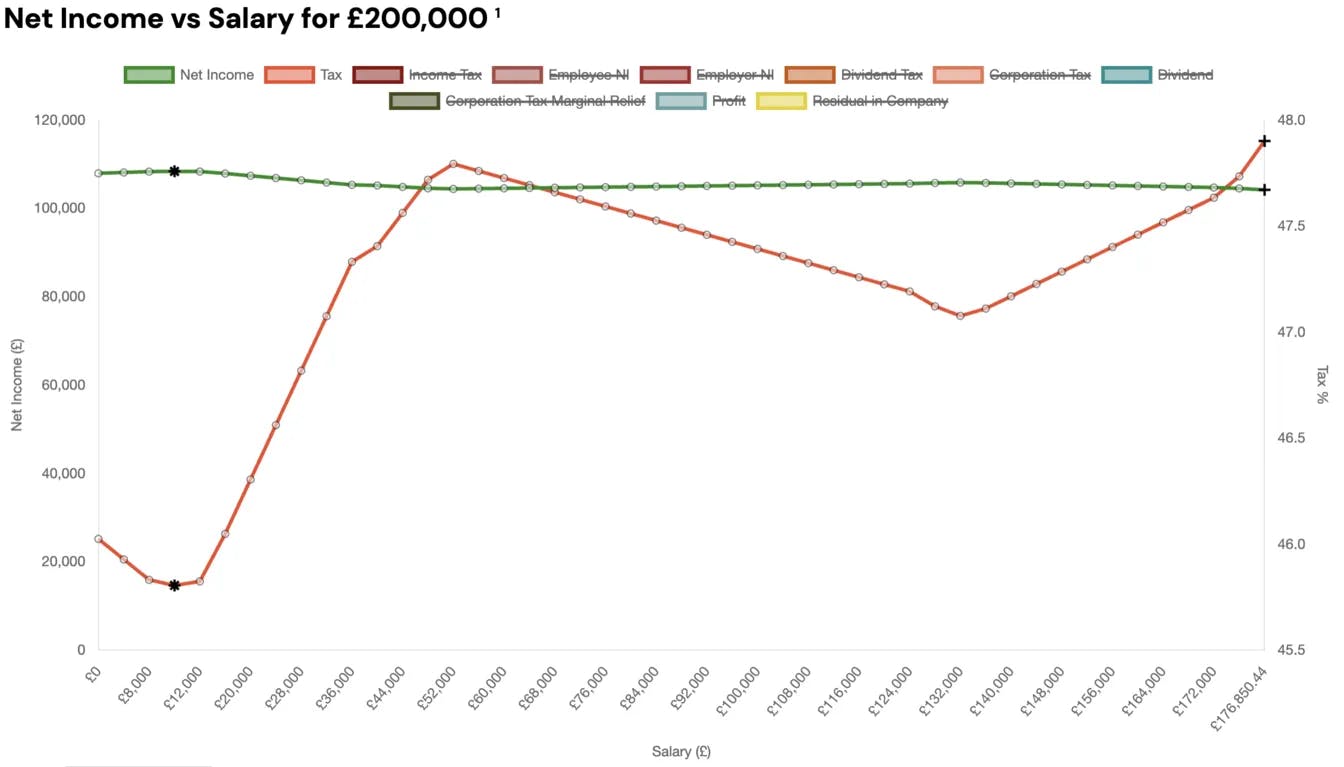

Below is an example graph and details for a £200,000 revenue company. The graph shows the tax and net income for different salary-to-dividend ratios with the salary along the X-axis.

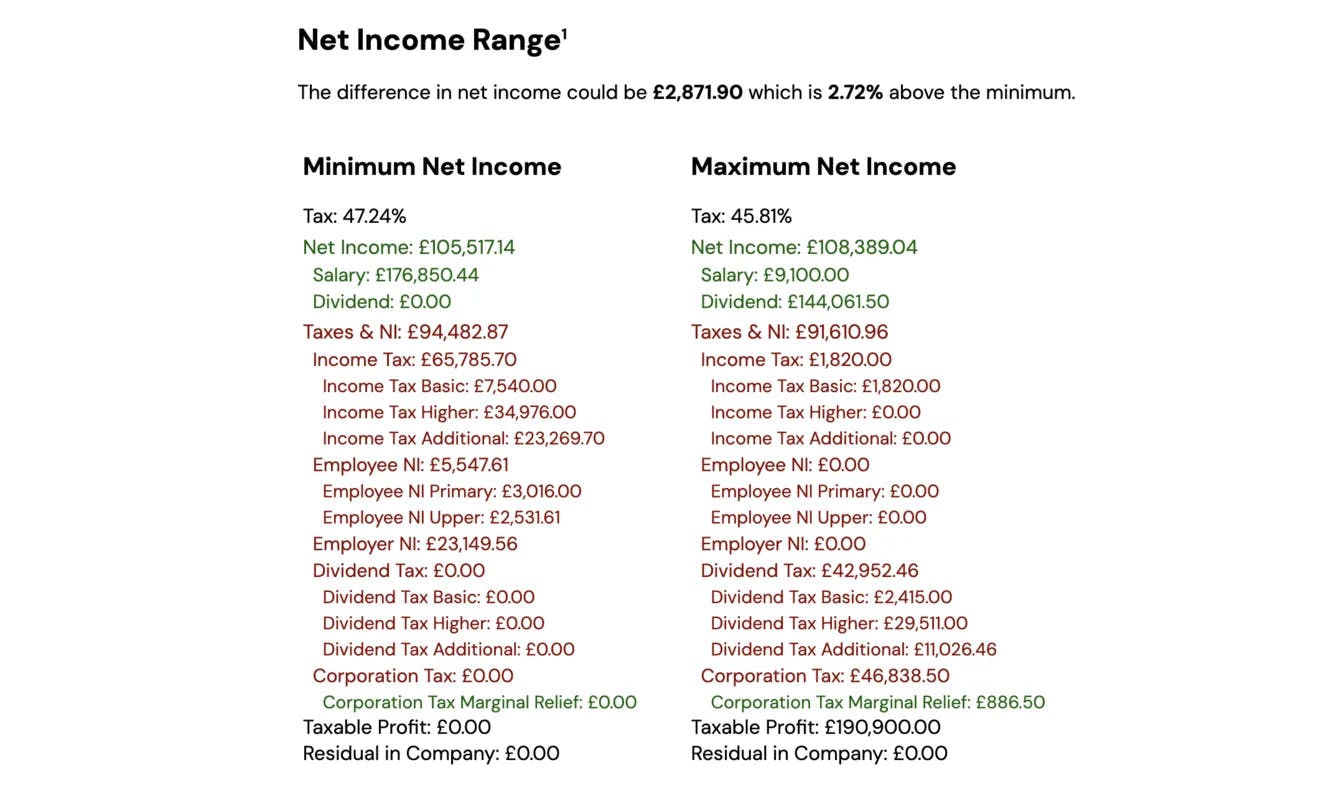

Additionally, a detailed breakdown shows the minimum and maximum net income and individual incomes, taxes and charges, see below.

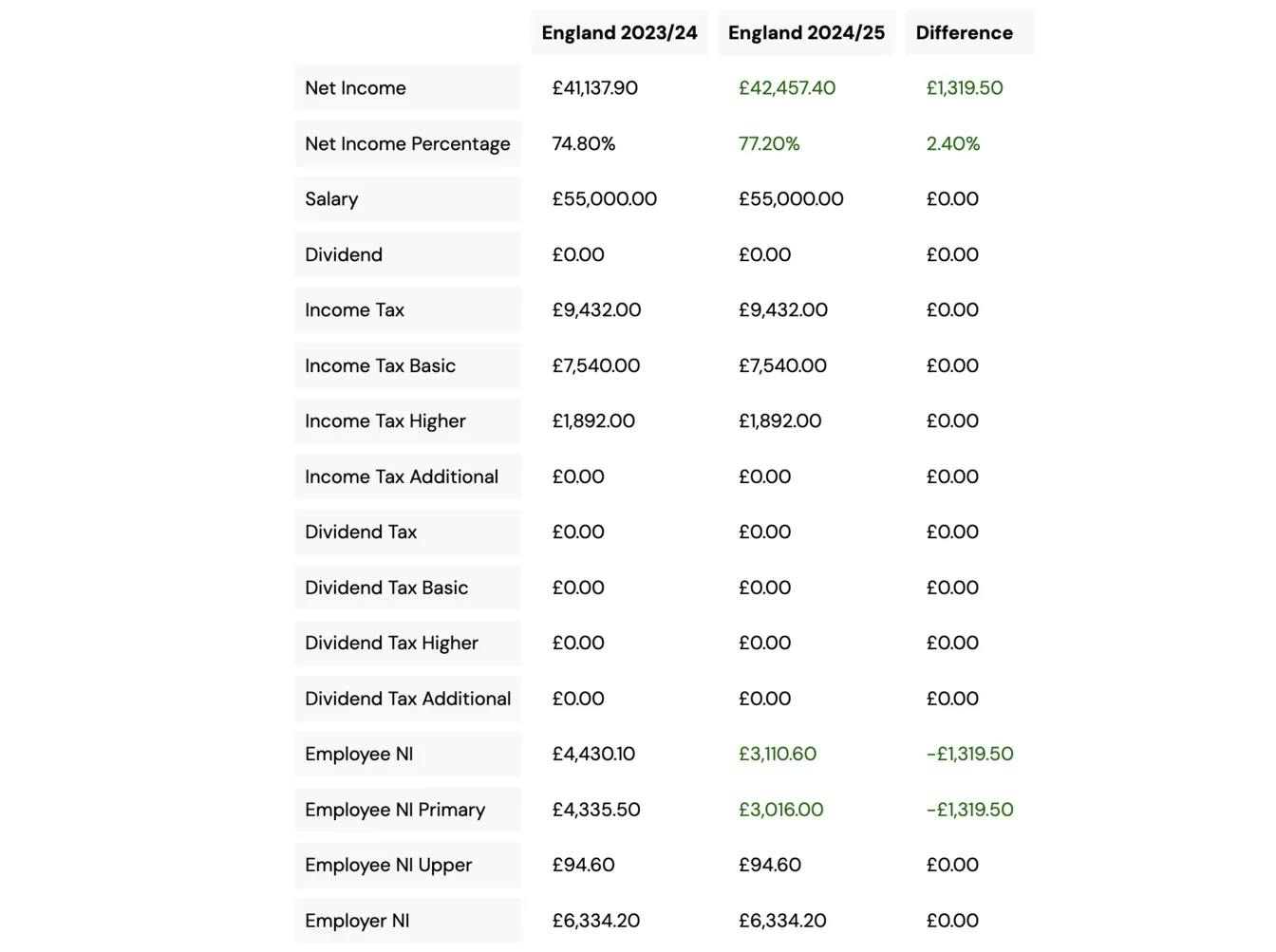

As a side effect, since the calculations are part of the above, Tax Shrink has to compute the income tax. That functionality is made available as a separate personal income tax calculator, including a line-by-line comparison of the 2023/24 and 2024/25 tax years for any salary and dividend income scenario.

Tax Shrink will add more features and capabilities in the future to allow more complex scenarios like multiple owners and other tax and income relevant details. It does not aim to replace professional accountants but be a tool for them or Directors to explore simplified but material scenarios and ideas. Give it a try and send some feedback to tax-shrink@bolddata.biz.

Christian Prokopp, PhD, is an experienced data and AI advisor and founder who has worked with Cloud Computing, Data and AI for decades, from hands-on engineering in startups to senior executive positions in global corporations. You can contact him at christian@bolddata.biz for inquiries.

Related Posts

How many words are 128k tokens?

2024-04-12

128k tokens are 96k words in English for ChatGPT 3.5 and 4. The ratio is estimated to be 0.75 words per token. However, the answer is not straightf...

Deep Dive into Code with ChatGPT

2023-04-04

Open Source libraries offer user documentation. But expert users and contributors have a deeper understanding of the inner workings stemming from a...

A Guide to the Delta Lake Transaction Log

2023-02-14

Discover the power of the Delta Lake transaction log - ensuring Data reliability and consistency.

The impact of Amazon's merchant datasets on E-commerce competition

2023-02-13

Get the insights you need to compete with Amazon with a comprehensive dataset.

A poem about Data

2022-12-05

Data is the root of all my worries ...

4 career tips I wish I knew

2022-05-25

When I mentor university students or discuss careers with the people I lead, I often draw from four pieces of advice. I wish I had known these when...